Executives rarely lie about their networks – they just misremember them. Ask a senior leader about their professional connections and you’ll hear confident claims about decades of relationships, industry contacts across multiple sectors, and a robust LinkedIn following. Then ask a harder question: “If you needed to make a major career move in the next six months, who could you actually call?” The list suddenly gets very short.

This gap between perceived network strength and actual network quality isn’t a character flaw. It’s a function of how executive careers develop. Your network wasn’t built for transformation – it was built for the context you were in when you built it. And that context no longer exists.

A network you can’t mobilize isn’t a network – it’s a contact list.

Your network quality is the third dimension of career readiness that the RUNWAY READY™ assessment evaluates, alongside financial runway and psychological readiness. Most executives score themselves well on the first two and poorly on this one – once they look honestly.

Why Your 2019 Network Won’t Save Your 2026 Career

The uncomfortable truth about executive networks: they reflect your past, not your future. The relationships you built climbing to your current role were perfectly suited to that climb. They connected you to people in similar positions, similar industries, and similar trajectories.

Research consistently shows that 70% of executive opportunities come through relationships rather than applications or recruiters. But this statistic cuts both ways. If your network is concentrated in domains being disrupted by AI, those relationships can’t open doors that don’t exist anymore.

Consider what’s changed since you built most of your network. Industries that were stable are now in structural decline. Roles that were prestigious are being restructured or eliminated. Companies where your contacts worked have been acquired, downsized, or transformed beyond recognition. Your network may be shrinking through no action of your own – simply because the professional world your contacts inhabited is shrinking.

The executive who needs to transform their career needs a network that can support transformation. That’s rarely the same network that supported their rise to their current position.

The Three Dimensions of Network Quality

Counting connections tells you nothing useful. Quality assessment requires examining three distinct dimensions.

Depth measures whether you have real relationships or just contact records. Can you ask someone for genuine help – an introduction, a reference, an honest assessment of your candidacy – or is your relationship limited to occasional information exchange? A depth score of 4-5 means you could call this person with a significant ask and expect a thoughtful response. A score of 1-2 means you’d need to re-establish the relationship before asking for anything meaningful.

Relevance examines whether your contacts exist in domains that matter for your future, not just your past. A CFO discovers that 80% of her network contacts are also in finance roles – useful for lateral moves, but limited for transformation into advisory or board work. Relevance isn’t about whether someone is “important” – it’s about whether their domain, expertise, and connections align with where you need to go.

Reciprocity tracks the balance of giving and taking in each relationship. Have you contributed value recently, or have you only reached out when you needed something? Relationships where you’ve only withdrawn eventually decline to zero – and attempting to withdraw from an empty account creates awkwardness at best, damage at worst.

Try this exercise: List your top 20 professional contacts. Rate each on a 1-5 scale for depth, relevance, and reciprocity. The resulting averages will tell you more about your network’s actual strength than any connection count ever could.

Domain Trajectory: Where Are Your Contacts Headed?

This is the AI-era-specific dimension most executives overlook entirely. Beyond depth, relevance, and reciprocity, you need to assess where your contacts’ domains are heading.

Categorize your significant contacts into four buckets:

Growing domains include AI-adjacent roles, transformation leadership, emerging sectors, and functions gaining strategic importance. These contacts can see opportunities before they’re visible to the market.

Stable domains encompass functions and industries maintaining their position – neither disrupting nor being disrupted. These contacts offer reliability but limited access to new possibilities.

Contracting domains cover roles being automated, functions being consolidated, and industries in structural decline. These contacts may be valuable colleagues but limited in their ability to create new opportunities for you.

Unknown applies to contacts you haven’t talked to recently enough to know where their domain is heading.

Now do the uncomfortable math. A CTO realizes his strongest relationships are with former colleagues at companies that have since been acquired or downsized – his network is literally shrinking through no action of his own. A CMO who built his career at traditional CPG companies finds that most of his network is in sectors facing AI-driven marketing automation pressure – they’re all worried about the same thing.

If 70% of your contacts are in domains being disrupted by AI, your network is disrupting too – whether you realize it or not.

The relevant question isn’t “more connections versus fewer connections.” It’s “connections to growing domains versus connections to contracting domains.” This changes what “network building” actually means. Sometimes the best network investment isn’t meeting new people – it’s deliberately cultivating relationships in domains with better trajectories.

Understanding industry disruption patterns can help you assess which domains are growing and which are contracting.

The Network Debt Problem

Most executives carry significant network debt – relationships that have atrophied through neglect, not intention. Life happened. The job consumed everything. Maintaining relationships felt like a luxury you’d get to later.

Later arrived. And now reaching out feels impossibly awkward.

Here’s what I’ve learned from working with executives facing this situation: network debt is normal. Almost everyone has it. The executives who appear to have robust, active networks have usually just been more systematic about maintenance, not more naturally social.

The problem with network debt isn’t that it exists – it’s that it compounds. A relationship you could have reactivated with a simple coffee two years ago now requires significant context-setting and relationship rebuilding. And the longer you wait, the harder reactivation becomes.

There’s also a pride barrier that makes this worse. Reaching out after years of silence feels vulnerable. It feels like admitting you neglected the relationship. It feels like revealing that you need something now that you didn’t need before.

Network debt compounds. The longer you wait to reactivate dormant relationships, the harder reactivation becomes.

This is why navigating career transitions requires addressing network quality before you need the network. The time to reactivate relationships is when you don’t desperately need them – when reconnection can feel genuine rather than desperate, when you have time to give before you need to ask.

Executive-Specific Audit Challenges

If network maintenance were easy for senior leaders, everyone would do it. Several factors make it particularly challenging at the executive level.

Pride complicates everything. Executives build identities around being the ones who help others, not the ones who need help. Reaching out to network contacts can feel like admitting vulnerability – exactly what executive identity is constructed to avoid.

Visibility creates its own constraint. When you’re a known figure in your industry, who you meet with gets noticed. Suddenly activating dormant relationships can signal to the market that something’s happening with your career – the last message you want to send when you’re exploring options confidentially.

Reciprocity anxiety plagues executives who’ve been too busy to maintain relationships. “I haven’t given enough to ask” becomes a self-fulfilling prophecy that keeps the relationship dormant forever.

The trap is waiting until you need the network to build it. By then, it’s too late for genuine relationship development. The solution is reframing proactive network maintenance as leadership development, not as signaling desperation. The executives who maintain relationships consistently aren’t the desperate ones – they’re the strategic ones.

Working with a career transition coach can help you develop a network strategy that feels authentic rather than calculating, and navigate the pride barriers that keep many executives from taking this step.

Proactive network maintenance is leadership, not desperation.

Your Network Readiness Score

Your network readiness integrates into the broader RUNWAY READY™ assessment alongside your financial runway and psychological readiness. Together, these three dimensions determine how prepared you are for meaningful career transformation – and how quickly you can move when opportunity or necessity requires it.

Three numbers summarize your network position:

Depth average: Your mean depth score across your top 20 relationships. Below 3.0 indicates relationships too shallow to mobilize for significant help.

Domain health percentage: What percentage of your significant contacts work in growing or stable domains? Below 50% signals that your network is contracting alongside the domains it represents.

Recency score: What percentage of your top 20 relationships have you had meaningful contact with in the past 12 months? Below 60% indicates significant network debt requiring attention.

Your network needs will also differ depending on which path you choose. Transform paths require internal sponsors and organizational allies. Pivot paths need cross-industry bridges. Reinvention paths demand contacts in entirely new domains. Portfolio careers require diverse client sources and reputation across multiple communities.

Calculate your three numbers. Then complete the full network dimension within the RUNWAY READY™ Calculator to integrate this assessment with your financial runway and psychological readiness. The composite picture will tell you whether you’re ready for transformation – or whether network investment needs to happen before you can move.

Frequently Asked Questions

How do I honestly assess my network quality when I'm biased toward thinking it's stronger than it is?

The exercise is simple but uncomfortable: List 20 contacts. For each, answer honestly – when did you last have meaningful contact? Could you ask them for a significant favor right now? Would they respond positively? The data will override your assumptions.

What if most of my network is in the same industry I'm concerned about?

This is common and concerning. It means your network is correlated with the same risks affecting your role. Deliberate cultivation of relationships in different domains isn’t networking – it’s risk diversification.

How do I reach out to contacts I haven't talked to in years without seeming desperate?

Don’t wait until you need something. Reach out now with genuine interest in their work, with congratulations on their recent achievements, or with something of value to offer them. Relationship reactivation works best when there’s no immediate ask attached.

Can I rebuild my network quickly if I need to make a career move soon?

Quickly is relative. You can make meaningful progress in 3-6 months with consistent effort. But depth can’t be rushed – and it’s depth that determines whether your network can actually help when you need it. This is why executive transitions typically take 6-12 months – network development is often the limiting factor.

What if I'm more introverted and networking feels inauthentic to me?

Quality over quantity matters even more for introverts. You don’t need 2,000 connections – you need 20 relationships of real depth. Focus on the relationships that feel genuine, and invest in maintaining those consistently. That’s a much smaller lift than constant networking events.

Should I focus on building new relationships or maintaining existing ones?

For most executives, maintenance first. Reactivating dormant relationships is typically easier than building new ones from scratch, and those relationships already have history and context. Once existing relationships are healthy, then selective expansion makes sense.

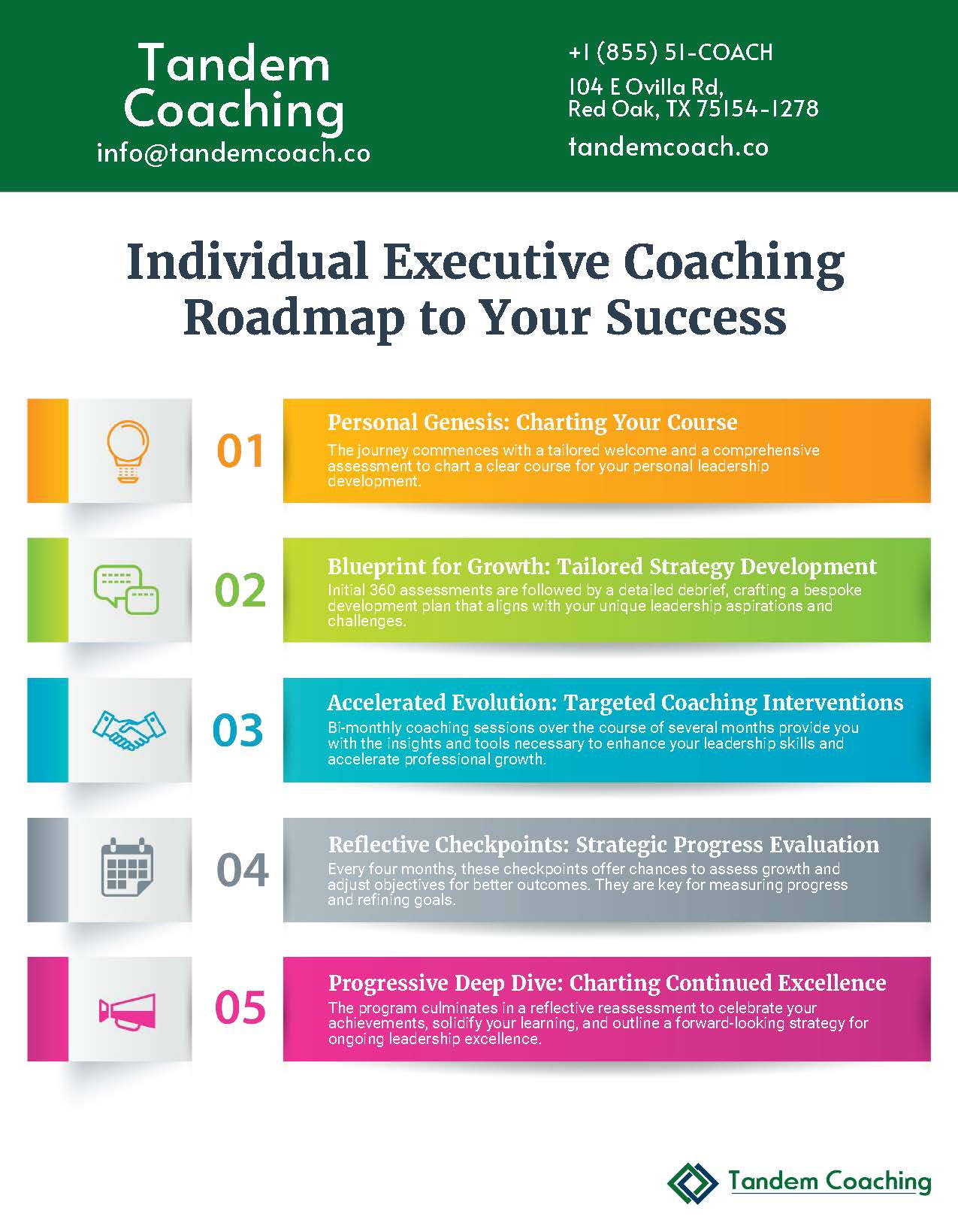

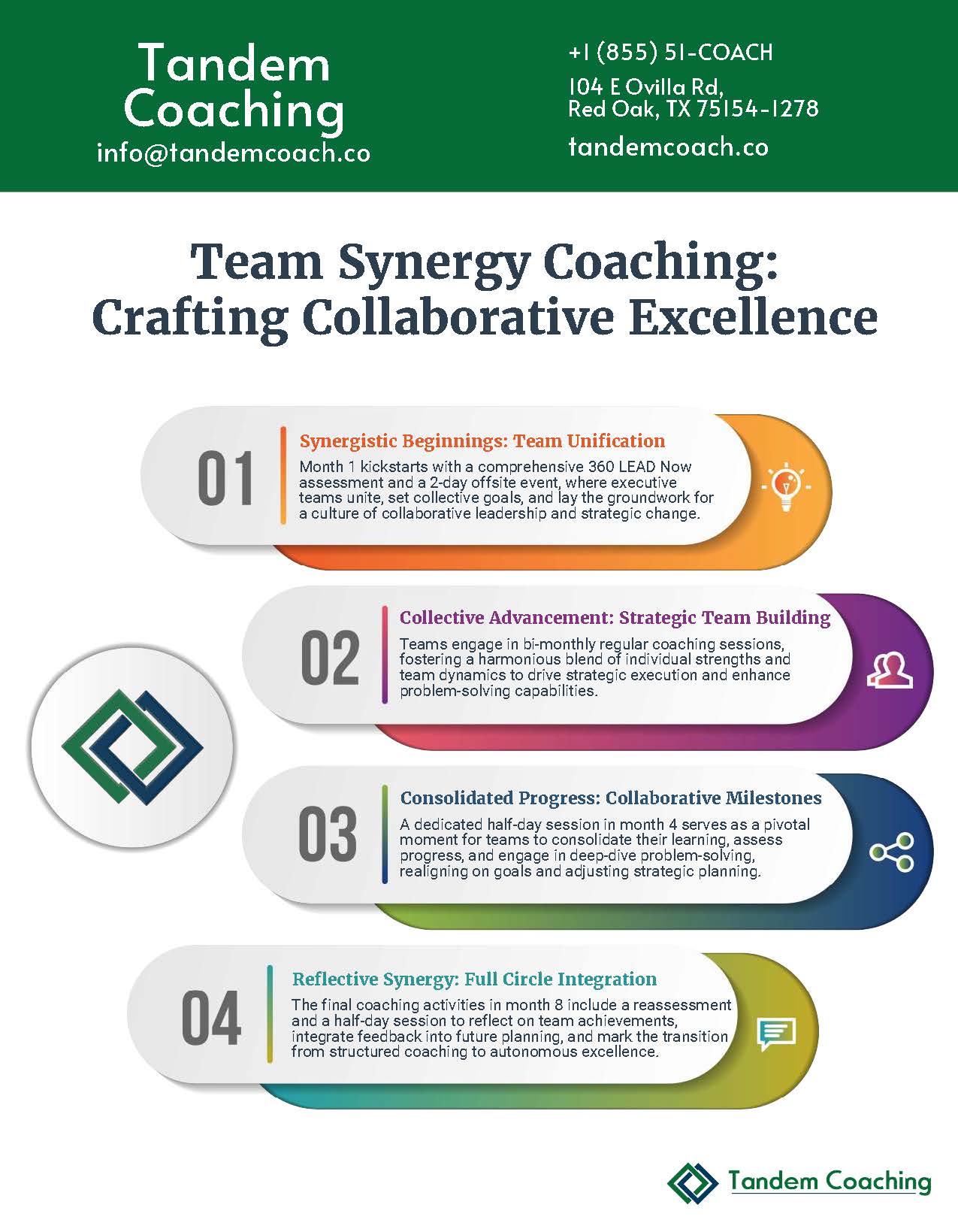

Boost Your Leadership Team Success!

Take your leadership team to the next level and achieve great results with our executive coaching.

Learn how our coaching and ASPIRE method can change things for you—get a free brochure to begin your journey.

About the Author

Cherie Silas, MCC

She has over 20 years of experience as a corporate leader and uses that background to partner with business executives and their leadership teams to identify and solve their most challenging people, process, and business problems in measurable ways.

![Best Leadership Development Tools [Top 5 Ranked and Compared]](https://cdn.tandemcoach.co/wp-content/uploads/2024/08/TC-113-1.jpg)