The difference between a Q4 departure and a Q1 departure can be worth six figures. Most executives don’t realize this until they’re already negotiating their exit – at which point the bonus they spent eleven months accruing vanishes because they didn’t wait thirty more days. That’s the kind of detail that separates strategic career planning from expensive improvisation.

If you’ve been operating on the assumption that “six months of savings” provides adequate runway for an executive transition, you’re working with advice designed for someone making a third of your salary with a tenth of your financial complexity. The standard emergency fund calculation doesn’t account for unvested RSUs, deferred compensation retrieval windows, COBRA costs at executive benefit levels, or the reality that senior roles take three to four times longer to fill than the positions you held a decade ago.

This isn’t about pessimism. It’s about math. And the math, done correctly, is actually liberating – because a clear number replaces the vague anxiety that keeps executives stuck in roles they should have left years ago.

Why Generic Savings Advice Fails Executives

The financial planning advice you’ll find in most career transition guides assumes a world where compensation means salary, benefits mean health insurance, and three months is a reasonable job search timeline. None of that applies to you.

Executive compensation is a puzzle with interlocking pieces. Your base salary might represent 40-60% of your total compensation, with the rest locked in equity vesting schedules, annual bonus cycles, deferred compensation arrangements, and benefits that cost $2,000-4,000 monthly to replace through COBRA. Walking away mid-cycle doesn’t just mean losing future compensation – it means forfeiting value you’ve already earned but haven’t yet received.

Then there’s the timeline reality. VP-level searches typically take four to six months. C-suite transitions routinely stretch to nine to twelve months. According to executive job search duration research, senior executives commonly spend six to twelve months in active search – and that’s with focused effort, not while quietly exploring options from your current role.

The “six-month emergency fund” advice assumes you’ll be employed again before it runs out. At the executive level, that assumption is dangerously optimistic.

The Three-Part Runway Calculation

Your actual runway isn’t a single number – it’s three dimensions that constrain each other. Miss any one of them, and your calculation is incomplete.

Financial Runway is the foundation: how many months can you sustain your household without income before you deplete resources you can’t afford to touch? This isn’t just monthly expenses multiplied by months. It includes transition costs that don’t exist in normal life: networking expenses (events, travel, meals), professional development, potential relocation, and the 1.5x multiplier that transition periods typically cost compared to normal months.

Psychological Runway is the dimension most executives ignore: how many months before financial stress begins degrading your decision-making? This number is almost always shorter than your financial runway. If you have 18 months of financial runway but start making fear-based decisions at month 8, your effective runway is 8 months.

Network Investment Runway accounts for the cost of meaningful relationship maintenance during transition. Seventy percent of executive opportunities come through relationships, not applications. That means your transition period requires active investment in your network – which costs money and time.

Let’s run this calculation on a real scenario. A VP of Finance at a mid-size tech company – call her a composite of several executives I’ve worked with. Her numbers:

- Monthly burn rate: $22,000 (mortgage, two kids in private school, one car payment, standard living)

- Liquid savings: $180,000

- Unvested RSUs: $240,000 (vesting over 3 years)

- Expected severance: 6 months salary ($150,000)

- COBRA cost: $3,200/month

- Realistic transition timeline: 9-12 months

Her financial runway looks like 18+ months on paper. But her psychological runway? She starts losing sleep at month 4 of unemployment. Her network investment costs about $1,500/month when she’s doing it properly. And those unvested RSUs? They require her to stay another 14 months to capture meaningfully.

Your runway isn’t what you have in the bank. It’s the shortest of three distances: financial, psychological, and network. Plan for the constraint that binds first.

Severance and Equity: The Numbers Most People Get Wrong

Severance negotiation has a timing problem: the best moment to negotiate is before you need it, not when you’re leaving. If your employment agreement doesn’t already include severance terms, your leverage evaporates the moment everyone knows you’re departing.

Current benchmarks from Challenger, Gray & Christmas’s 2025 Severance & Salary Benchmarking Report show C-suite leaders averaging 30-50+ weeks of severance, with VPs and Directors typically receiving 15-25 weeks. The average across all industries rose to 19.3 weeks in 2024 – up 24% from the prior year. These numbers matter because they establish what “reasonable” looks like if you’re negotiating without pre-existing terms.

Equity creates its own complexity. Vesting cliffs create a “rolling prison” effect – there’s always another cliff coming, always another reason to wait. RSUs vesting in November look like “almost there” in August. Then February’s grant starts its clock. Then the annual refresh. Three years pass while you wait for the optimal moment that never arrives.

Every vesting cliff looks like “almost there.” That’s the golden handcuffs working exactly as designed. Calculate the actual dollar value of staying versus the career cost of waiting – then decide with real numbers, not rolling hope.

The question isn’t whether to leave before vesting. It’s whether the career opportunity cost of waiting exceeds the equity value you’d capture. That’s a calculation, not a feeling.

Bonus timing matters more than most executives realize. A Q4 departure means forfeiting eleven months of accrued bonus. A Q1 departure after bonus payment captures that value. The difference can equal two to four months of additional runway – which, given executive search timelines, might be the difference between strategic patience and desperate compromise.

The Lifestyle Adjustment Trap

Here’s where the math gets uncomfortable.

Most executives, when they sketch out a “reduced expenses” budget during transition, create something I call the Spreadsheet Optimist scenario. They see a number – say, cutting monthly burn from $22,000 to $13,000 – and feel reassured. Excel accepts any number you type; reality doesn’t.

The problem isn’t willingness to cut. It’s sustainable cutting. The country club membership looks like an obvious reduction until you realize it’s where your network activates. The private school tuition seems negotiable until your spouse reminds you that yanking kids mid-year isn’t actually on the table. The “we’ll eat at home more” line item ignores that networking dinners are a transition expense, not a luxury.

Realistic adjustments run 10-20% of current spending. Executives who plan for 40% cuts almost always burn through runway faster than projected, then make desperate decisions around month 8 instead of strategic decisions around month 14.

Here’s what the math doesn’t capture – and this matters. Some of that spending isn’t about lifestyle. It’s about identity. The club membership isn’t about golf; it’s about who you are among your peers. The neighborhood isn’t about square footage; it’s about the story you tell yourself about your success. Cutting those expenses means confronting questions about identity that most executives would rather avoid.

That confrontation might be necessary. But pretending it’s purely a spreadsheet exercise leads to plans that collapse on contact with reality.

When Your Runway Shapes Your Path

Your financial runway doesn’t just determine how long you can search – it determines which career paths are even available to you.

If you’re working with the RUNWAY READY™ assessment, here’s how the tiers translate to options:

Under 6 months: Transform path only. You cannot afford an extended transition, which means your only viable option is evolving your current role or moving to a similar role quickly. Pivot and Reinvent require more time than you have.

6-11 months: Transform or cautious Pivot possible. Timeline pressure is real, but you have enough runway to explore adjacent moves if you move efficiently.

12-17 months: Transform, Pivot, or portfolio career viable. You have genuine optionality. Complete career reinvention is risky at this runway level but not impossible if other readiness factors align.

18+ months: All four paths available. Full optionality. You can afford the longer timeline that Reinvent requires, you can build a portfolio career from scratch, or you can be highly selective about Transform and Pivot opportunities.

This is why runway calculation matters before path selection. Trying to pursue a Reinvent path with 8 months of runway isn’t brave – it’s financially reckless. And choosing Transform by default because you never calculated your runway means you might be constraining yourself unnecessarily.

A 12-month runway doesn’t just buy time. It buys choices. Knowing your number turns “I can’t afford to leave” into “here’s what each path actually requires.”

The TRANSITION BRIDGE™ framework integrates runway as one of five criteria for path selection. But runway is often the binding constraint – the criterion that eliminates options before you even evaluate fit or readiness.

Building Your Runway Number

If you’re avoiding the calculation because you’re afraid of what it might reveal, you’re not alone. Most executives I work with have some version of a number in their head – usually optimistic, usually incomplete, and usually serving the purpose of avoiding a harder conversation.

The RUNWAY READY™ Calculator takes about 15 minutes. Before you start, you need three numbers:

- Your actual monthly burn rate – not what you think you spend, but what your bank statements show you spend. Include everything: mortgage, cars, insurance, kids, subscriptions, the dining and travel that’s become invisible.

- Your liquid reserves – savings and accessible investments, not retirement accounts you’d pay penalties to access or equity in assets you can’t sell quickly.

- Your expected severance – either from your employment agreement or a realistic estimate based on your level and tenure. If you don’t have contractual severance, use zero until you’ve negotiated something.

The output tells you your runway in months and which TRANSITION BRIDGE™ paths that runway supports. It doesn’t tell you what to do – that’s a different question. But it tells you what’s actually possible, which is where strategic planning starts.

If you want guidance on navigating a career transition at the executive level, the financial dimension is where many coaches begin – because everything else depends on knowing how much time you actually have.

Your financial runway is one dimension. The psychological question – how many months before financial stress degrades your decision-making – is addressed in the next piece in this assessment series. But start with the money. The numbers don’t lie, and they don’t negotiate with your preferences.

Frequently Asked Questions

How long do executive transitions really take?

VP-level searches typically take 4-6 months with focused effort. C-suite transitions commonly stretch to 9-12 months. Plan for the longer end of these ranges – it’s easier to accelerate a well-funded search than to extend a desperate one.

What's the difference between an emergency fund and a transition fund?

An emergency fund covers unexpected job loss – it’s defensive, and you hope never to use it. A transition fund is offensive – it’s the career investment account that lets you make strategic moves. Confusing them means depleting your safety net on a planned transition, leaving your family exposed to actual emergencies.

Should I wait for my equity to vest before leaving?

Calculate the actual dollar value of the equity against the career opportunity cost of waiting. If you’re watching your market position erode while waiting for a vesting cliff that’s “almost here,” you’re paying for that equity with career capital that may be worth more.

How do I factor severance into my runway calculation?

If you have contractual severance, include it as a known number. If you don’t, assume zero until you’ve negotiated something – many executives overestimate what they’ll receive in an unplanned departure.

What career paths require what amount of runway?

Transform requires the least (under 6 months can work). Pivot needs 6-12 months minimum. Portfolio careers need 12-18 months to build multiple income streams. Reinvent requires 18+ months for the complete transition most executives underestimate.

How do I handle COBRA costs at executive benefit levels?

Executive-level health benefits often cost $2,500-4,000 monthly to continue through COBRA. Factor this as a fixed cost for at least 6-12 months of your transition. Some severance packages include continued coverage – if yours doesn’t, negotiate for it.

What if I'm the sole or primary earner?

Your psychological runway is likely shorter than your financial runway. Build in a buffer for the stress of provider responsibility, and be honest about when financial pressure will start affecting your judgment.

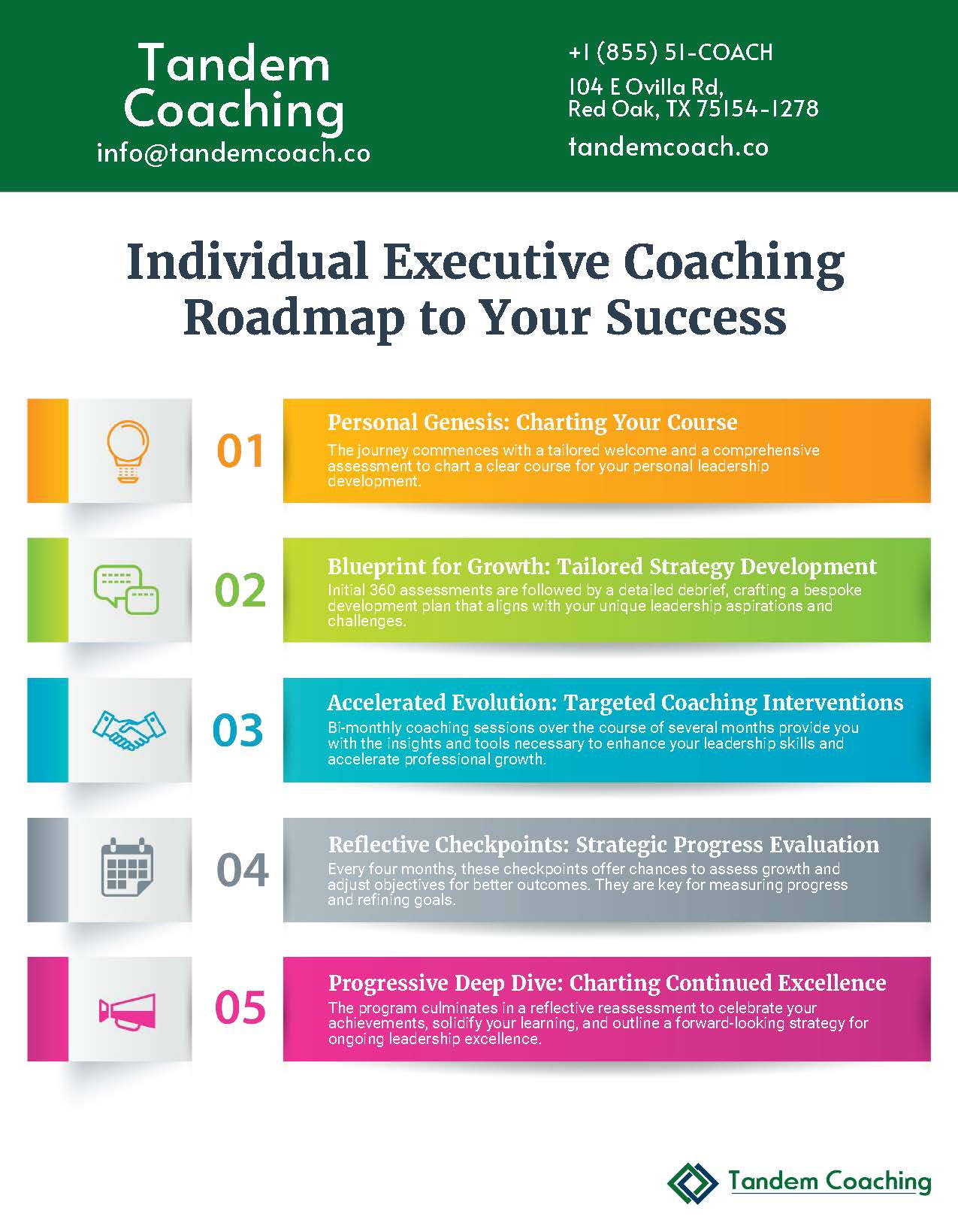

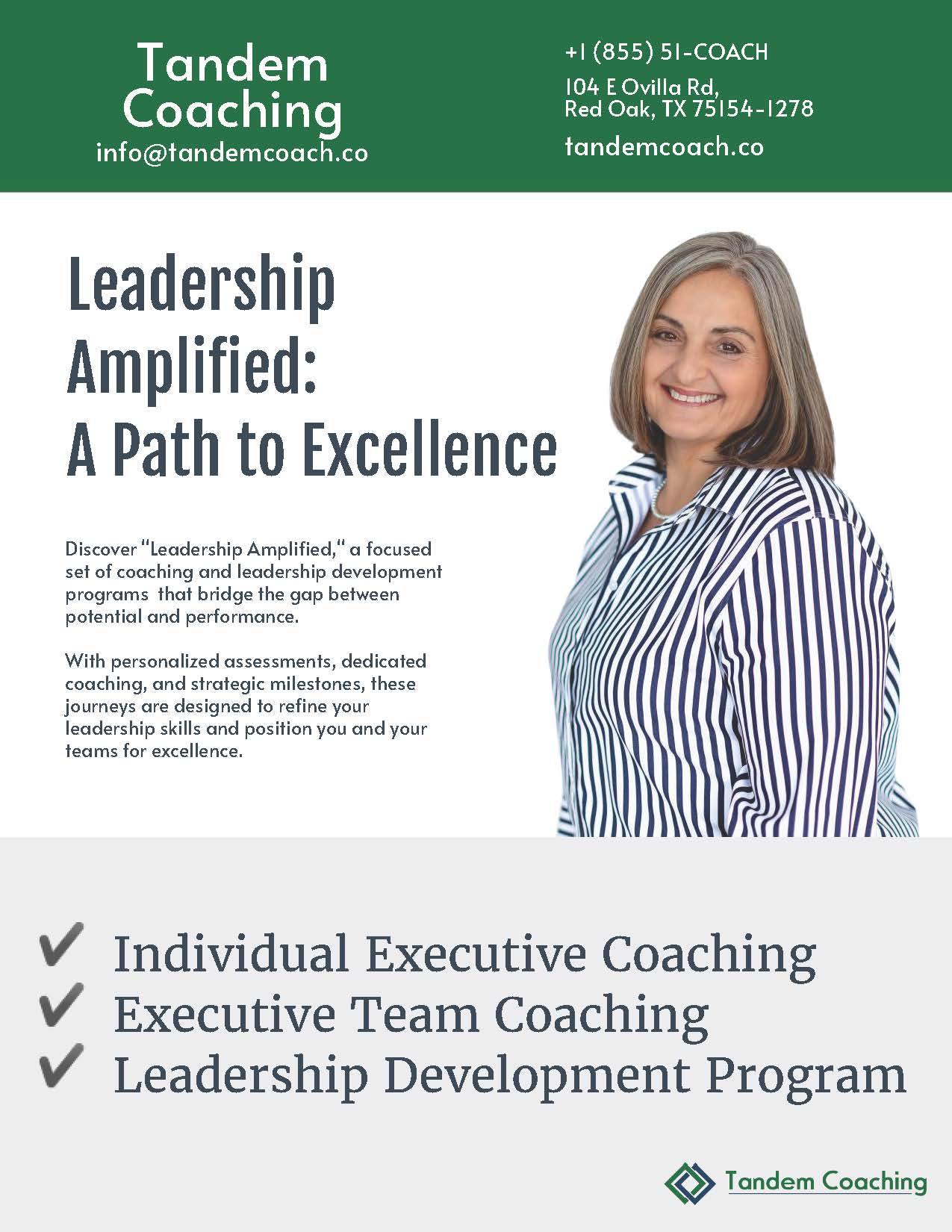

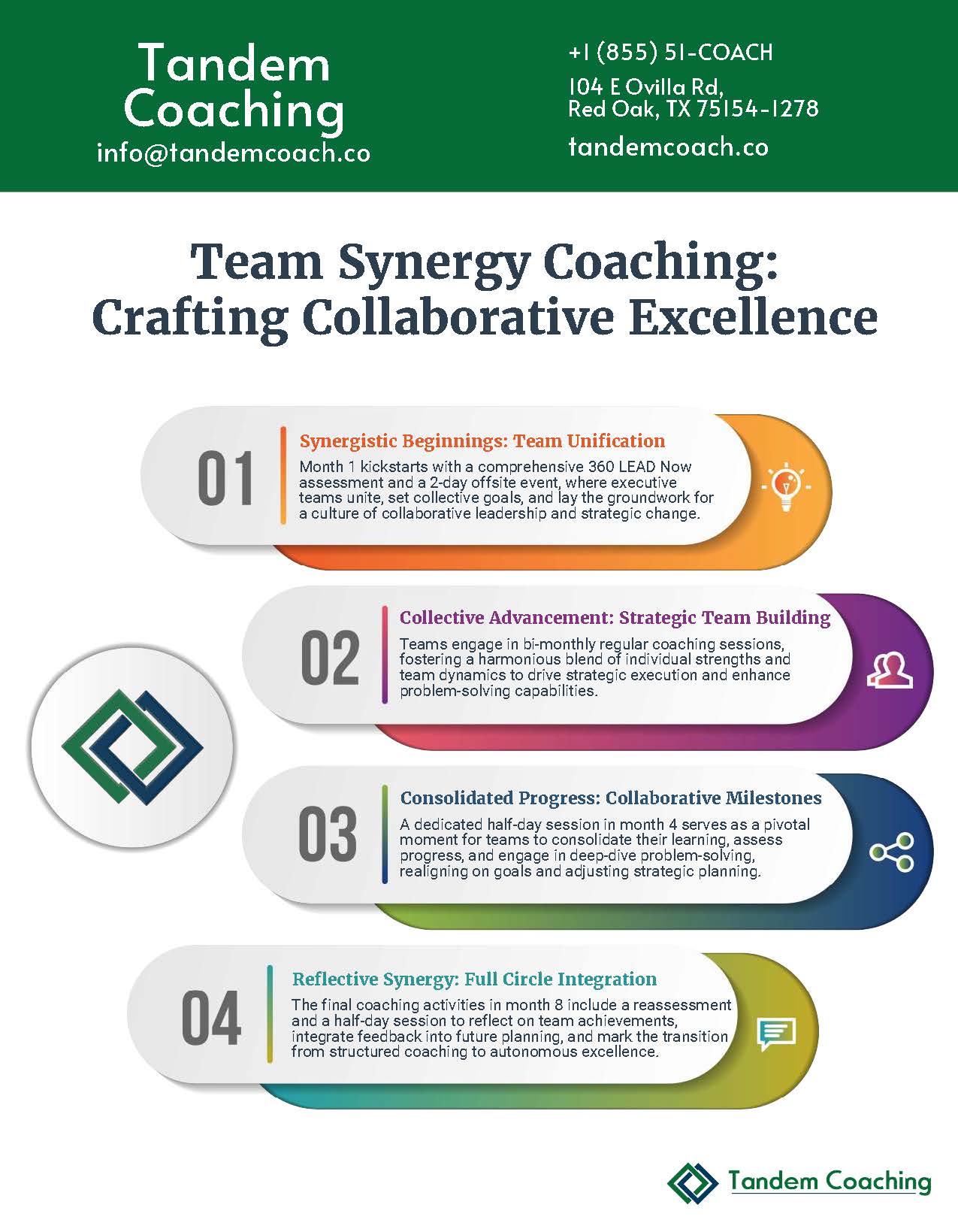

Boost Your Leadership Team Success!

Take your leadership team to the next level and achieve great results with our executive coaching.

Learn how our coaching and ASPIRE method can change things for you—get a free brochure to begin your journey.

About the Author

Cherie Silas, MCC

She has over 20 years of experience as a corporate leader and uses that background to partner with business executives and their leadership teams to identify and solve their most challenging people, process, and business problems in measurable ways.